eFIRDS

Download product sheetA European Financial Instruments Reference Data System providing access to key data points on more than 34 million securities from over 50,000 issuers. eFIRDS increases transparency into the European capital markets and offers flexible ways of accessing the information either via web or automated API and feed delivery.

The service offers you data, information and insights to help you cope with regulatory data requirements for compliance needs, such as LEI, ISIN, CFI and MIC codes. In addition, you are able to verify if an instrument is listed on a recognized trading venue in Europe, and which instruments are listed by a certain company and its subsidiaries.

Our database is updated daily and sources data from a variety of sources, first and foremost key databases in Europe such as ESMA FIRDS, FCA FIRDS, and GLEIF. The data is first scrubbed before we map it together to form our enhanced eFIRDS dataset.

By using eFIRDS you can monitor new instruments based on your personal filters, including market, type, and currency. After tracking down an instrument you can save it as a favorite to make sure to stay updated on daily changes in the instrument’s reference data.

A short summary of eFIRDS key features:

-

- SEARCH issuers, LEI codes and ISINs listed on any recognized trading venue in EU and UK

- OVERVIEW legal entities’ listed equity, debt and derivative instruments

- ACCESS reference, liquidity and regulatory data to comply with trading regulations such as Mifid/Mifir, EMIR, SFTR and other

- VERIFY recognized trading venues on financial instrument level including regulated markets, MTFs, OTFs and SIs

- FIND liquidity flags, thresholds and the most liquid trading venue on a financial instrument level

- OBTAIN and verify company data, LEI codes, including new issuance and renewal of LEIs

- NAVIGATE a company’s corporate group structure and legal entity information (LEI) including parent relationships linked to outstanding financial instruments

- TRACK new listings and financial instruments by their market and currency, filter and save your own personal favorite instruments

Transparency and liquidity data is crucial information in today’s financial markets, not only for research and analysis but perhaps more importantly for regulatory reporting purposes.

Allow for our service to help provide you with the pre- and post-trade transparency data you need. By using eFIRDS you will gain insights and indications of trading activity in financial instruments, including output such as:

-

- Liquidity flag

- Standard market size

- Total number of transactions

- Total volume of transactions

- Average daily turnover

- Average daily number of transactions

- Average daily transaction values

- Most relevant market in terms of liquidity

- Average daily number of transactions on MRMTL

For more information, please contact our sales team at sales@efirds.eu or visit efirds.eu.

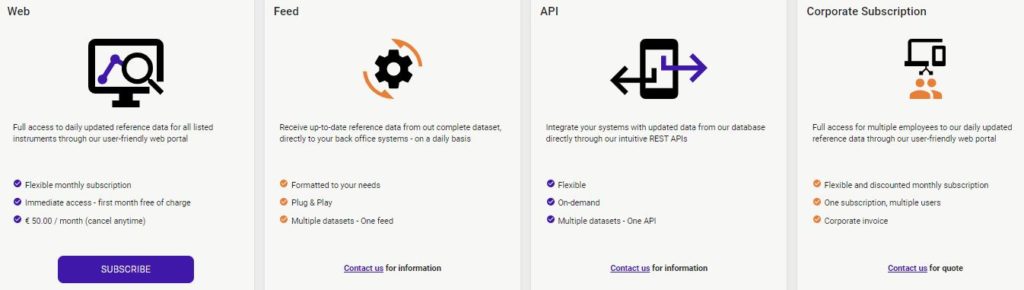

Available eFIRDS service subscriptions

Download product sheet